Budget बनाना akshar aakho par पट्टी बांधकर Rubik’s cube ko हल karne jaysa lagta hai – निराशजनक aur bhari। Lakin kya hoga agar aapke वित्त ko स्पष्टता lane ke liye eak saral, lachila dhacha ho? 50/30/20 niyam अपनाए, eak Budget ranniti अपनाए jo jitni saral hai उतनी ही प्रभावी bhi hai।

Senator Elizabeth Warren aur उसकी बेटी Amelia Warren Tyagi dwara apni पुस्तक All Your Worth: The Unlimited Lifetime Money Plan, mein लोकप्रिय, yah niyam jarurato, इच्छाओं aur balancing lakshyo ko santulit karne ka खाका pesh krta hai। Aayea jane ki yah kaam kaise karta hai, yah kyu santulit प्रतिनिधित्व होता है, और aap ise aapne jivaan mein kaise dhal sakte hai।

Contents

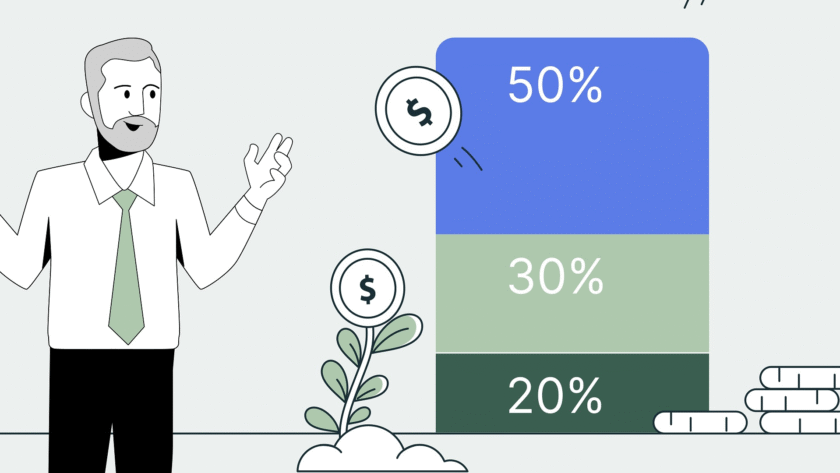

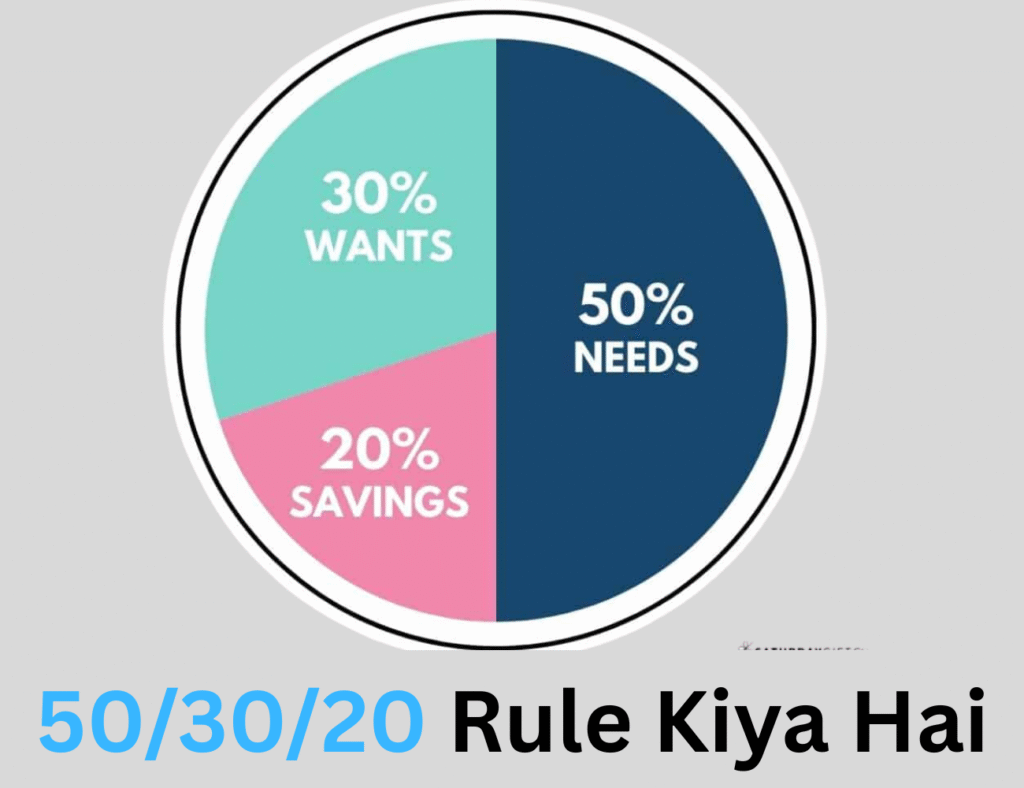

50/30/20 Rule Kiya Hai

Yah Niyam Aapki After-Tax आय ko तीन श्रेणियों mein wibhajit karta hai:

- आवश्यकता ke लिए 50%: ऐसे आवाश्यक व्यय Jinhe aap tal nhi sakte।

- इच्छाओं ke liye 30%: ऐसी jivanselli विकल्प jo khushi dete hain।

- Bachat/ऋण ke liye 20%: suraksha ka nirman aur ऋण ka bhuktan।

Yah koi kathor Sutra Nhi Hai, Balki Har Dollar ka सूक्ष्म prabandhan kiye bina aapko prathimakta tay karne mein madad karne ke liye eak दिशानिर्देश hai।

50/30/20 श्रेणियों Ka विभाजन

Jarurat (50%): Non-Negotiables

Jarurate जीवित Rahne Aur Buniyad Kamkaaj ke liye jaruri kharch hai। Soche:

- आवास ( kriyaa/bndhak)

- उपयोगिताएं (Bijli, Paani)

- किराने का Saman ( bahar khana nhi)

- Beema ( स्वास्थ्य, Car)

- न्यूनतम ऋण Bhugtan (Dand Se Bachna)

Example: Yadi Aapka take-home wetan $4,000/mah hai, to jarurato ko $2,000 par simit rakhe।

Reality ki Jach: Bureau of Labour Statistics ke anushar, aushat U.S. pariwar apni आय का 33% akale awash par kharch krta hai – Yah Darshata hai ki sabhi jarurato ke liye 50% par tike rahana चुनौतीपूर्ण kyu ho skta hai, khashkar ucch lagat wale क्षेत्रों में।

Pro Tips: aapki jarurate 50% se adhik hai, to kharche ki jach kare। Kiya aap apne bandhak ko refinance kar sakte hai? Eak sasti phone yojana par Switch kare?

Caahat (30%): Majedaar Cheeje

चाहतें Aapke Jeevan ko bethar banati hai, lakin jaruri nhi hai:

- Bahar Khana

- Streaming Sewaye

- Chuttiya

- Designer कपड़े

उदाहरण: $4,000 ki aay ke sath, $1,200 ko cahato par kharch kare।

Gray Areas: Kya Gym Membership eak jarurat hai ya cahat? Sandarv mayane rakhta hai।

Exeprt Insights: Financial Psychologist Brad Klontz ne Note kiya hai ki इच्छाओं par soch samajhkar kharch karne se khushi badhti hai, lakin jarurat se jayada kharch karne se “budget badhta hai।”

बचत/ऋण (20%): Aapka Financial Suraksha Jaal

Yah श्रेणी Aapke Bhawshiya ko surakshit karti hai:

- Emergency Fund (3-6 महीने ke kharcho ke liye lakshya)

- Retirement (401(k), IRA)

- Atirikit ऋण bhukataan ( न्यूनतम se pare)

Kathor Satya: 2023 ki Federal Reserve Bank Report Mein paya gya ki 37% अमरीकी $400 ki Aapatkalin स्थिति को कवर nhi kar sakte। Bachat ko prathimakta dena mahatwapurn hai।

Case Study: $50k/वर्ष कमाने wali sikshika Sarah ne छात्र ऋण ka bhuktan karte hua दो वर्ष mein $10,000 ka Aapatkalin kosh banane ke liye 20% niyam ka upyog kiya।

Expert Backing: Suze Orman bachat ko swachalit karne ki wakalat karti hai: “pahle khud ko bhuktan kare, koi bahana nhi।”

Lachilapan: Niyam Ko Apne Liye Kargar बनाना

50/30/20 Rule sabhi ke liye eak jaysa nhi hai। Iske aadhar par समायोजन kare:

- Ucch ऋण: ऋण chukoti ke liye allocate kare।

- Ucch aay wale: Bachat ko 20% se adhik badhaye।

- Variable आय: Masik aushot ka upyog kare।

Regional Adjustment: San Francisco jaise saharo mein, jaha kriya aay ka 40%+ hisaa le lete hai, ” आवश्यकताओं” ki seema अस्थायी rup se badh sakti hai।

Kya 50/30/20 Niyam Aapke Liye Sahi Hai?

Fayade:

- Saralta: Koi Jatil Spreadsheet Nhi।

- Santulan: Bachat karte hua jeevan ka aanand lene ko प्रोत्साहित karta hai।

- अनुकुलानशीलत: Adikanch आय स्तरों के liye kaam karta hai।

Nukshan:

- Atyadhik udar “चाहते हैं”: 30%derail logo ko patri se uttar sakta hai।

- ऋण sankato koandekha karta hai: उच्च ब्याज wale ऋण wale logo ko apni icchao ko 10% tak kam karne ki आवश्यकता हो sakti hai।

- Wirodhi dristikon: Wittya Guru Dave Ramsey sakth niyantran ke liye “zero-based bachat” ko prathimakta dete hai। Phir Bhi, 50/30/20 niyam suruati logo ke liye eak sandar suruati bindu bana hua hai।

Suruat: Chote Kadam, Bada Ashar

- Kar ke baad aay ki गणना kare: Wetan, side hustles aur recurring bonuses samil kare।

- वर्तमान kharch ko track kare: Mint ya You Need budget jaise app ise swachalit karte hai।

- Dheere dheere samayojit kare: Har Mahine bachat mein 5% adhik shift kare।

Pro Move: Bachat khate mein स्थानांतरण को swachalit kare taki “sets and forget।”

Niskarsh: Financial Confidence ke liye aapka marg

50/30/20 niyam पूर्णता ke bare mein nhi hai – yah pragati ke bare mein hai। आवश्यक cheeze, khushiya aur kal ki suraksha ko suntalit karke, aap eak स्थाई rup se वित्तय jeevan banate hai। Chaye aap apne pahle Wetan Ke sath college graduates ho ya bandhak aur daycare ke bich suntaln बनाने wala pariwar, yah dhacha aapki yatra ke anukul hai।

jaisa ki Warren aur Tyagi likhte hai , “Lakshya dukh ki aur apne paise bachana nhi hai, Balki eak ऐसा jeevan बनाना है जहां आपका paisa aapki सेवा kare।” Aaj se suru kare, आवश्यकतानुसार badlaw kare aur apne वित्तीय tanaw ko dur hote dekhe।

Aapki Baari: Aap 50/30/20 niyam ka upyog karke Apne agle Wetan ka आवंटन kaise karange?